How Predictive Customer Lifetime Value Drives Revenue

Winning and retaining customers is an expensive investment. That is why it is crucial to invest primarily in those customers who are profitable for the organization in the long term. It is important to understand customers, engage them in the right channels, and tailor offers to their context and needs. This can only be achieved by drawing on customer-related metrics, and the primary metric is the customer lifetime value (CLV).

Looking to the future, how does predictive customer lifetime value impact the revenue generation strategy? By reading this article, you will be able to understand how to use predictive customer lifetime value to gather historical data, get more sales, and increase customer retention.

7 minute read

Table of Contents

- How Predictive Customer Lifetime Value Drives Revenue

- Collecting the right data throughout the customer journey

- Predicting customer lifetime value

- How to leverage predictive CLV and drive revenue

- Value of predictive CLV for product development and marketing strategies

- Empowering customer relations by predicting CLV

- Enhancing marketing and sales efforts based on CLV prediction

- Key takeaways

- Hand-picked resources on analytics and insights

Collecting the right data throughout the customer journey

To estimate the current and future value of customers, organizations should collect and analyze tons of customer data and their journey.

These four data categories are essential to measure customer demand and build a successful buying funnel:

-

Transaction data such as shopping timeline, product information, prices, method of payment, delivery, or returns, is supplied by the customer data platform and the connected financial systems.

-

Demographic data such as gender, age, occupation, and place of residence, is condensed into customer profiles in order to better predict future shopping behavior and personalize marketing actions.

-

Engagement data such as responses to campaigns, and external online data, helps to get deeper insights about the customers’ preferences or purchasing behavior.

-

Behavioral data such as customer experience, net promoter score (NPS), and sentiments, helps to measure customer loyalty and satisfaction with the brand and products.

Predicting customer lifetime value

There are a number of analytics models to calculate customer lifespan. Business leaders can choose the best model that will suit the business they operate, the historical data they have, and the quality of insights they want to access.

-

Descriptive model: Insights into the past

Descriptive analysis helps business leaders and professionals learn from past behaviors, and understand how they might influence future outcomes. It calculates CLV using historical consumer data and identifies behavioral patterns of customer groups mostly through simple manual analysis. These insights can only serve as an initial indicator of CLV for potential decisions.

-

Predictive model: Insights into the future outcomes

Customer lifetime value predictive analytics is focused on understanding the future and provides organizations with actionable insights. This kind of analysis uses historical data patterns to determine future CLV and forecast what might happen. Using it, business leaders can access highly accurate predictions to make effective decisions.

-

Prescriptive model: Insights into the possible outcomes

Prescriptive analysis helps to check out a number of different possible outcomes, providing insights to business owners. Organizations benefit from customer lifetime prediction using machine learning as it makes recommendations to quantify the effect of future decisions. Using it, organizations can choose the actionable scenario that will bring the best possible outcomes.

How to leverage predictive CLV and drive revenue

Predictive CLV helps organizations better manage their budgets for customer acquisition and customer retention, and lets them easily calculate the return on investment of each customer. Customer lifetime value predictive analytics is aimed to measure not just sales revenue for each customer but how profitable they are.

By understanding how to predict customer lifetime value, organizations can quantify the total expected profit that a customer can bring within a specific period. They can plan the expenses, time, and effort that can be put in, proportional to the expected profits.

The marketing strategies can also become more effective when they focus on CLV prediction because they will become aware of the expected profits. As a result, business leaders can allocate marketing budgets accordingly because there is no guesswork involved in preparing them.

With a high-quality and accurate prediction of CLV, business leaders can identify the most profitable customers and invest in acquiring and retaining them. All this helps to find the key to unlocking continued and consistent profits.

Value of predictive CLV for product development and marketing strategies

Customer lifetime value is a great metric to measure and optimize product development and marketing strategy. Calculating the predictive customer lifetime value gives a chance to know what products high-value customers purchase, what products should be marketed the most, what future products should be developed, and what products should be bundled together or should be used for up-selling.

Previously, organizations have been segmenting customers by simply grouping them into similar cohorts based on features they believe are relevant. Today, the approach to building a successful product development strategy has changed and is more focused on calculating the predictive customer lifespan and comparing this metric with the number of units sold.

Organizations can define groups of products with high accuracy:

- Developing Products: High CLV, Low Units Sold

That can mean a newer product, and so boosting marketing spending will hopefully drive more unit sales while keeping the customer CLV high.

- Champion Products: High CLV, High Units Sold

Organizations can examine what exactly sets this product above the rest, and use this to create future product offerings that strive to replicate the success of champion products.

- Lagging Products: Low CLV, High Units Sold

The best strategy will be to reduce the marketing spend for these products and to see if smaller, more targeted efforts can help raise the product’s CLV. Also, organizations can bundle them with champions or develop products.

- Disappointing Products: Low CLV, Low Units Sold

For products with low CLV and low units sold, it’s necessary to stop selling. The disappointing product offering is diverting resources from more profitable deals.

Empowering customer relations by predicting CLV

Today, the customer relationship strategy is very important as it makes customers feel satisfied while using the products and services. All this directly impacts the speed of sales growth.

Predicting customer lifetime value helps to model a customer’s purchasing behavior, predict customer retention, forecast future revenue, and many more:

- Improve Customer Loyalty

Calculating CLV prediction, organizations can analyze the customers who make repeated purchases over time. If organizations can sustain it over the expected customer lifespan, they can earn loyal customers and brand promoters.

- Build Better Customer Relationships

CLV insights help organizations create hyper-targeted interactions to build long-term relationships with customers rather than just satisfy them. With value-based segmentation, it’s possible to focus on segments with a higher probability of customer retention to improve the revenue further with personalized interactions.

- Predict & Reduce Customer Churn

Customer lifetime value predictive analytics helps organizations see early signs of customer churn and take necessary actions to retain them. By combining predictive CLV with customer experience score and purchase history, business professionals can see which churned customers hold the potential to bring in higher profits if they are successfully retained. It also helps to identify customers with high order value and highly predictive CLV who haven’t purchased for some time.

Enhancing marketing and sales efforts based on CLV prediction

Predicting customer lifetime value helps businesses develop strategies to acquire new customers and retain existing ones while maintaining profit margins. The Predictive CLV opens more insights for organizations and helps:

- Know Who Will Become Most Valuable Customers Next Year

Predictive CLV shares insights about who the most valuable customers were and currently are. It helps to understand how much the customers are likely to spend in the future over a certain time frame.

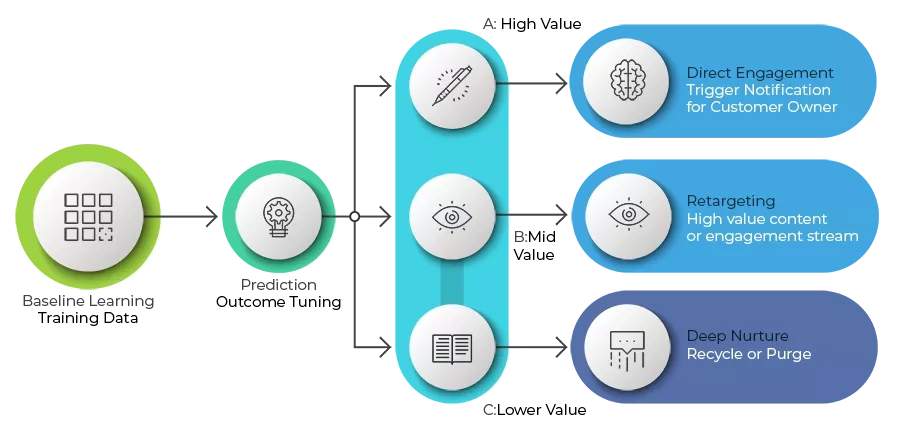

- Improve Customer Segmentation Strategy

By calculating the CLV prediction, organizations can find the segments that can bring in higher profits and double down on efforts to increase the customer retention rate of these high-value customers. This accurate segmentation helps focus on low-level customers that may not have a high average order value but can provide more profits over the long term.

- Optimize Marketing Strategies

CLV prediction helps to answer important questions with high accuracy: which marketing channel will be the most effective for a customer, how much revenue should be attributed to each marketing channel, and how much money should be spent on each channel.

- Reduce Customer Acquisition Cost

Predicting customer lifetime value helps organizations target only those potential customers whose lifetime value makes it worth the user acquisition cost. The prediction insights help reduce acquisition costs for new users and optimize the return on investment (ROI).

Key takeaways

Customer lifetime value prediction is a great way to get valuable insights about customer acquisition, marketing efforts, and future financial outcomes. Monitoring predictive CLV is essential for business leaders to forecast the monthly or annual revenue from different customer types.

The predictive capability gives organizations the precise information they need to provide a great customer experience, grow the number of deals, and decrease customer acquisition cost. This will give more focus to growing more profitable relationships with current and future customers.

Business leaders and professionals regularly use the predictive analysis of CLV to build long-term and positive relationships with customers, grow sales, and reduce acquisition costs. Are you looking for an effective solution to calculate predictive CLV for your business? Reach out to the Put It Forward team to discuss your specific needs.

Elsa Petterson

Partner success manager @ Put It Forward